What is a business partner? A business partner of Thomas Beaudoin can be defined as an individual or group of individuals who work together in a business, sharing profits and losses.

A business partner can be a valuable asset to a company, providing additional skills, experience, and financial resources. Partners can also help to share the workload and decision-making, which can free up the business owner to focus on other aspects of the business.

There are many different types of business partnerships, each with its own advantages and disadvantages. Some of the most common types of partnerships include general partnerships, limited partnerships, and limited liability partnerships.

The type of partnership that is right for a particular business will depend on a number of factors, including the number of partners, the level of liability that each partner is willing to assume, and the tax implications of the partnership.

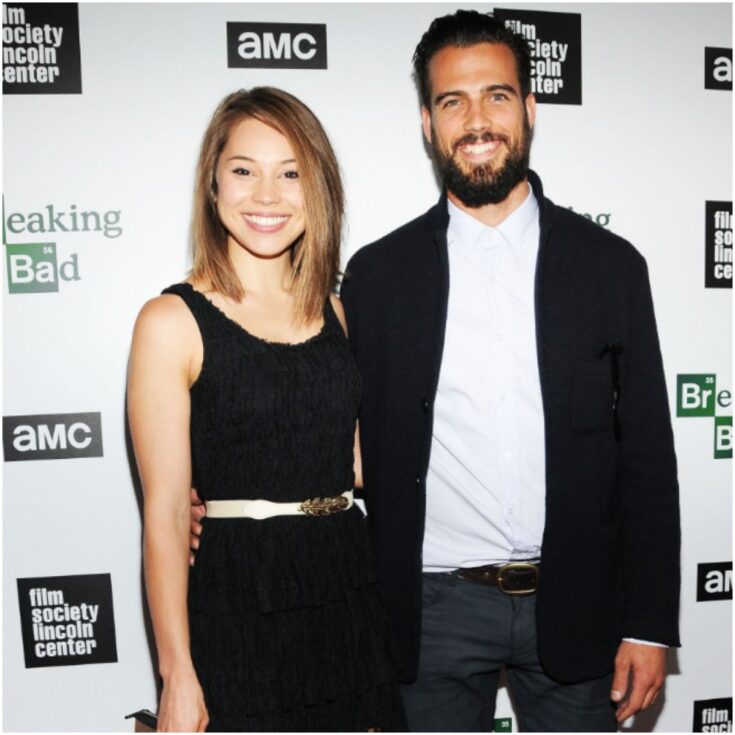

thomas beaudoin partner

A business partner is an individual or group of individuals who work together in a business, sharing profits and losses. There are many different types of business partnerships, each with its own advantages and disadvantages. The type of partnership that is right for a particular business will depend on a number of factors, including the number of partners, the level of liability that each partner is willing to assume, and the tax implications of the partnership.

- Definition: A business partner is an individual or group of individuals who work together in a business, sharing profits and losses.

- Types: There are many different types of business partnerships, including general partnerships, limited partnerships, and limited liability partnerships.

- Advantages: Business partners can provide additional skills, experience, and financial resources. They can also help to share the workload and decision-making.

- Disadvantages: Business partners can also create additional liability and conflict.

- Considerations: The type of partnership that is right for a particular business will depend on a number of factors, including the number of partners, the level of liability that each partner is willing to assume, and the tax implications of the partnership.

- Examples: Some well-known business partnerships include Bill Gates and Paul Allen (Microsoft), Steve Jobs and Steve Wozniak (Apple), and Larry Page and Sergey Brin (Google).

- Conclusion: Business partnerships can be a valuable asset to a company, but it is important to carefully consider the advantages and disadvantages before entering into a partnership agreement.

Definition

This definition is important in understanding the concept of "thomas beaudoin partner" because it highlights the key characteristics of a business partner. A business partner is someone who works with another person or group of people in a business venture, and they share the profits and losses of the business. This is in contrast to an employee, who is paid a salary or wage for their work and does not share in the profits or losses of the business.

In the case of "thomas beaudoin partner", this definition is particularly relevant because it helps to clarify the relationship between Thomas Beaudoin and his business partner. Thomas Beaudoin is a well-known businessperson who has been involved in a number of successful ventures. His business partner is someone who has worked with him on these ventures and has shared in the profits and losses of the businesses.

Understanding the definition of a business partner is important for a number of reasons. First, it helps to clarify the roles and responsibilities of each person involved in a business venture. Second, it can help to avoid misunderstandings and conflict between business partners. Third, it can help to ensure that all business partners are treated fairly and equitably.

Types

The type of business partnership that is right for Thomas Beaudoin and his partner will depend on a number of factors, including the number of partners, the level of liability that each partner is willing to assume, and the tax implications of the partnership.

- General partnerships are the most common type of business partnership. In a general partnership, all partners are jointly liable for the debts and obligations of the partnership. This means that if the partnership is sued, any of the partners can be held personally liable for the judgment.

- Limited partnerships are similar to general partnerships, but they offer some protection to limited partners. In a limited partnership, there are two types of partners: general partners and limited partners. General partners are jointly liable for the debts and obligations of the partnership, while limited partners are only liable for the amount of money that they invested in the partnership.

- Limited liability partnerships (LLPs) are a type of partnership that offers limited liability to all partners. This means that if the LLP is sued, the partners are not personally liable for the judgment. LLPs are often used by professionals, such as lawyers and accountants, who want to protect their personal assets from liability.

Thomas Beaudoin and his partner should carefully consider the different types of business partnerships before deciding which type is right for them. They should also consult with an attorney to discuss the legal implications of each type of partnership.

Advantages

In the case of "thomas beaudoin partner", this advantage is particularly relevant because it highlights the benefits that Thomas Beaudoin's partner can bring to the business. Thomas Beaudoin is a successful businessperson with a strong track record of success. His partner can provide additional skills, experience, and financial resources that can help to grow the business and achieve even greater success.

- Additional skills and experience: A business partner can bring a variety of skills and experience to the table. This can be especially helpful for businesses that are looking to expand into new markets or offer new products or services. For example, if Thomas Beaudoin is looking to expand his business into a new market, his partner could provide the necessary language skills and cultural knowledge to help the business succeed.

- Financial resources: A business partner can also provide additional financial resources to the business. This can be helpful for businesses that are looking to invest in new equipment or expand their operations. For example, if Thomas Beaudoin is looking to purchase new equipment for his business, his partner could provide the necessary financing to make the purchase possible.

- Sharing the workload: A business partner can also help to share the workload. This can be especially helpful for businesses that are experiencing rapid growth or that are facing a number of challenges. For example, if Thomas Beaudoin's business is experiencing rapid growth, his partner could help to manage the day-to-day operations of the business, freeing up Thomas Beaudoin to focus on other aspects of the business.

- Sharing decision-making: A business partner can also help to share decision-making. This can be especially helpful for businesses that are facing complex decisions or that are looking to make major changes. For example, if Thomas Beaudoin is looking to make a major change to his business, his partner could provide input and help to make the best decision for the business.

Overall, the advantages of having a business partner can be significant. Business partners can provide additional skills, experience, financial resources, and help to share the workload and decision-making. This can be especially beneficial for businesses that are looking to grow and succeed.

Disadvantages

In the case of "thomas beaudoin partner", this disadvantage is particularly relevant because it highlights the potential risks that Thomas Beaudoin could face by entering into a partnership. While a business partner can provide a number of advantages, it is important to be aware of the potential disadvantages as well.

- Additional liability: One of the biggest disadvantages of having a business partner is that it can create additional liability. This means that if the partnership is sued, both partners could be held personally liable for the judgment. This is especially important to consider for businesses that are operating in high-risk industries, such as construction or manufacturing.

- Conflict: Another potential disadvantage of having a business partner is that it can lead to conflict. This can occur for a variety of reasons, such as disagreements over the direction of the business, financial disputes, or personal conflicts. If conflict is not managed properly, it can damage the partnership and even lead to its dissolution.

Overall, it is important to carefully consider the potential disadvantages of having a business partner before entering into a partnership agreement. While a business partner can provide a number of advantages, it is important to be aware of the potential risks as well.

Considerations

When considering a business partnership, there are a number of factors that must be taken into account in order to determine the type of partnership that is right for the business. These factors include the number of partners, the level of liability that each partner is willing to assume, and the tax implications of the partnership.

The number of partners is an important factor to consider because it will affect the way the partnership is structured and managed. For example, a general partnership is a type of partnership in which all partners are jointly liable for the debts and obligations of the partnership. This means that if the partnership is sued, any of the partners can be held personally liable for the judgment. A limited partnership is a type of partnership in which there are two types of partners: general partners and limited partners. General partners are jointly liable for the debts and obligations of the partnership, while limited partners are only liable for the amount of money that they invested in the partnership.

The level of liability that each partner is willing to assume is another important factor to consider. Some partners may be willing to assume more liability than others. For example, a general partner is jointly liable for the debts and obligations of the partnership, while a limited partner is only liable for the amount of money that they invested in the partnership.

The tax implications of the partnership are also an important factor to consider. The type of partnership that is chosen will affect the way that the partnership is taxed. For example, a general partnership is taxed as a pass-through entity, which means that the income of the partnership is passed through to the partners and taxed on their individual tax returns. A limited partnership is taxed as a corporation, which means that the partnership itself is taxed on its income.

In the case of "thomas beaudoin partner", it is important to consider all of these factors when choosing the type of partnership that is right for the business. Thomas Beaudoin and his partner should carefully consider the number of partners, the level of liability that each partner is willing to assume, and the tax implications of the partnership before deciding on a partnership structure.

Examples

These examples highlight the importance of business partnerships in the success of some of the world's most well-known companies. In each of these cases, the partners brought complementary skills and experience to the table, and they were able to work together to create something truly special.

In the case of thomas beaudoin partner, the partnership between Thomas Beaudoin and his partner has been instrumental in the success of their business. Thomas Beaudoin is a successful businessperson with a strong track record of success. His partner brings additional skills and experience to the table, and they are able to work together to make their business a success.

The examples of Bill Gates and Paul Allen, Steve Jobs and Steve Wozniak, and Larry Page and Sergey Brin show that business partnerships can be a powerful force for success. When two or more people with complementary skills and experience come together, they can create something truly special.

Conclusion

In the case of "thomas beaudoin partner", this conclusion is particularly relevant because it highlights the importance of carefully considering the advantages and disadvantages of a business partnership before entering into a partnership agreement. Thomas Beaudoin is a successful businessperson with a strong track record of success. His partner brings additional skills and experience to the table, and they are able to work together to make their business a success.

- Facet 1: Advantages of business partnerships

Business partnerships can provide a number of advantages, including additional skills and experience, financial resources, and help to share the workload and decision-making. In the case of "thomas beaudoin partner", the partnership has allowed Thomas Beaudoin to expand his business into new markets and offer new products and services.

- Facet 2: Disadvantages of business partnerships

Business partnerships can also create additional liability and conflict. In the case of "thomas beaudoin partner", it is important to carefully consider the potential risks before entering into a partnership agreement.

- Facet 3: Considerations for business partnerships

When considering a business partnership, there are a number of factors that must be taken into account, including the number of partners, the level of liability that each partner is willing to assume, and the tax implications of the partnership. In the case of "thomas beaudoin partner", it is important to carefully consider all of these factors before deciding on a partnership structure.

Overall, it is important to carefully consider the advantages and disadvantages of a business partnership before entering into a partnership agreement. In the case of "thomas beaudoin partner", the partnership has been a success because Thomas Beaudoin and his partner have carefully considered the advantages and disadvantages and have worked together to create a successful business.

Frequently Asked Questions

Frequently asked questions regarding "thomas beaudoin partner" are addressed in this section to provide a comprehensive understanding of relevant queries.

Question 1: What is the definition of a business partner?

A business partner is an individual or group of individuals who collaborate in a business venture, sharing its profits and losses.

Question 2: What are the different types of business partnerships?

Common types of business partnerships include general partnerships, limited partnerships, and limited liability partnerships.

Question 3: What are the advantages of having a business partner?

Business partners offer a range of benefits, including shared skills, experiences, financial resources, and workload, enabling businesses to expand, innovate, and succeed.

Question 4: What are the disadvantages of having a business partner?

Potential disadvantages include increased liability and potential conflicts arising from differing perspectives or goals.

Question 5: What factors should be considered when choosing a business partner?

Key considerations involve the number of partners, liability assumptions, tax implications, and alignment of values and objectives.

Question 6: What are some examples of successful business partnerships?

Notable examples include Bill Gates and Paul Allen (Microsoft), Steve Jobs and Steve Wozniak (Apple), and Larry Page and Sergey Brin (Google), demonstrating the power of collaborative partnerships.

In summary, business partnerships offer both advantages and potential drawbacks. Careful consideration of factors like liability, tax implications, and partner compatibility is crucial for success.

This concludes the FAQ section on "thomas beaudoin partner".

Conclusion

The exploration of "thomas beaudoin partner" reveals the significance of business partnerships in entrepreneurial endeavors. Partnerships offer a range of advantages such as shared expertise, financial resources, and workload distribution, fostering business growth and resilience.

However, it is essential to carefully evaluate the potential drawbacks, including increased liability and potential conflicts. Meticulous consideration of factors like the number of partners, liability assumptions, and tax implications is crucial to establishing a successful partnership.

Ultimately, business partnerships can be powerful vehicles for driving innovation, expanding market reach, and achieving long-term success. By thoughtfully navigating the advantages and disadvantages, and fostering a spirit of collaboration, partners can harness the full potential of their collective efforts.

The Meaningful Bond: Florence Welch's Romantic Endeavors

Stunning Photos Of K Annamalai IPS's Wife: Unveiling Her Beauty

Crystal & Candice: The Ultimate Guide To Their Dynamic Duo

Thomas Beaudoin Wife Biography Famous People Today

Thomas Beaudoin Height, Age, Net Worth, Affair, Career, and More

Thomas Beaudoin Wife Biography Famous People Today